Title: Discovering the Path to Success in Stocks and Futures Trading

Introduction:

Stocks and futures trading can be highly profitable, but success in these markets requires a combination of knowledge, skills, and a welldefined strategy. In this article, we will explore the key factors and principles that contribute to success in stocks and futures trading.

1. Education and Research:

To succeed in stocks and futures trading, it is crucial to have a solid understanding of financial markets, economic indicators, and trading strategies. Continuous education and research are essential for staying updated with market trends, analyzing data, and making informed trading decisions. It is recommended to invest time in studying technical analysis, fundamental analysis, and risk management techniques.

2. Developing a Trading Strategy:

A welldefined trading strategy is a cornerstone for success in stocks and futures trading. A trading strategy should include clear entry and exit rules, risk management guidelines, and a plan for portfolio diversification. Before executing any trades, traders must define their risk tolerance and set realistic profit targets. Regularly reviewing and adapting the trading strategy based on market conditions is crucial for longterm success.

3. Risk Management:

Successful traders understand the importance of managing risk. Risk management techniques, such as setting stoploss orders, position sizing, and diversification, are essential for preventing significant losses and ensuring consistent returns. Traders should never risk more than a small percentage of their trading capital on a single trade and should always have a plan to mitigate potential losses.

4. Emotional Discipline:

Controlling emotions is vital for success in stocks and futures trading. Traders should avoid making impulsive decisions based on fear or greed. Successful traders adhere to their trading plans and stick to their strategies, even during periods of market volatility. Implementing strict risk management rules and developing the ability to detach emotions from trading decisions can significantly enhance profitability.

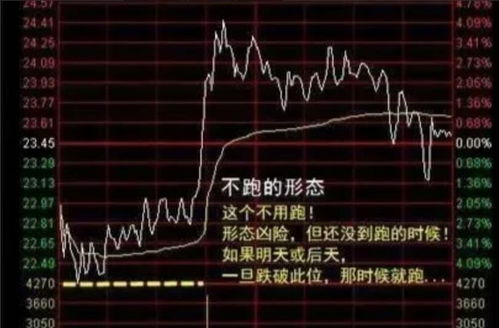

5. Market Analysis and Timing:

Successful traders have a thorough understanding of market analysis techniques and the ability to identify profitable opportunities. Technical analysis, chart patterns, and indicators can help traders identify trends, support, and resistance levels, and potential entry and exit points. Additionally, keeping track of economic events, corporate earnings reports, and global news can provide valuable insights for making informed trading decisions and timing trades effectively.

6. Continuous Learning and Adaptation:

The financial markets are dynamic, and successful traders continuously adapt their strategies to changing market conditions. Embracing new technologies, learning from past trades, and analyzing market data are crucial for staying ahead of the curve. Successful traders always strive to expand their knowledge and refine their skills to achieve consistent profits.

Conclusion:

The path to success in stocks and futures trading lies in ongoing education, developing a robust trading strategy, managing risks effectively, controlling emotions, conducting thorough market analysis, and adapting to changing market conditions. By honing these skills, traders can increase their chances of achieving consistent profitability in the highly competitive world of financial trading. Remember that perseverance, discipline, and continuous learning are essential traits of successful traders.